We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Written by

Holly D. Johnson

Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics. In addition to writing for Bankrate and CreditCards.com, Johnson does ongoing work for clients that include CNN, Forbes Advisor, LendingTree, Time Magazine and more.

Edited by

Brooklyn Lowery

Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Bankrate logoAt Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

InterContinental Hotels Group (IHG) includes 19 hotel brands and over 6,000 hotels and resorts around the world. A stay with IHG could include a luxury vacation at a Kimpton location, an InterContinental resort property or even a Crowne Plaza. It could also include a quick stop at a local roadside hotel like a Holiday Inn, Holiday Inn Express or Staybridge Suites, among others.

By signing up for IHG One Rewards, the hotel group’s loyalty program, you could make your vacation even better with savings and on-property benefits like room upgrades and free internet access. In this guide, we explain how the IHG One Rewards program works, how to earn points and the best ways to use them.

When IHG Rewards revamped its loyalty program in early 2022, the name of the program changed to IHG One Rewards. Other updates made the program more generous and useful overall as it now offers more benefits, redemption methods and elite status tiers.

Members still earn points on hotel stays and other qualifying activities, which can then be used for free nights, airline miles, merchandise and a handful of other redemption options. There are also numerous ways to earn IHG points, including with paid hotel stays in IHG properties, spending on co-branded credit cards and travel bookings with partners.

As of July 2024, free hotel stays within the 6,000+ hotels associated with IHG One Rewards start at just 5,000 points. You can also pay for a hotel stay redemption, typically called a Rewards Night, entirely with points or with a combination of points and cash. And like other hotel programs, IHG One Rewards has elite status tiers you can earn, which come with more travel perks and opportunities for rewards.

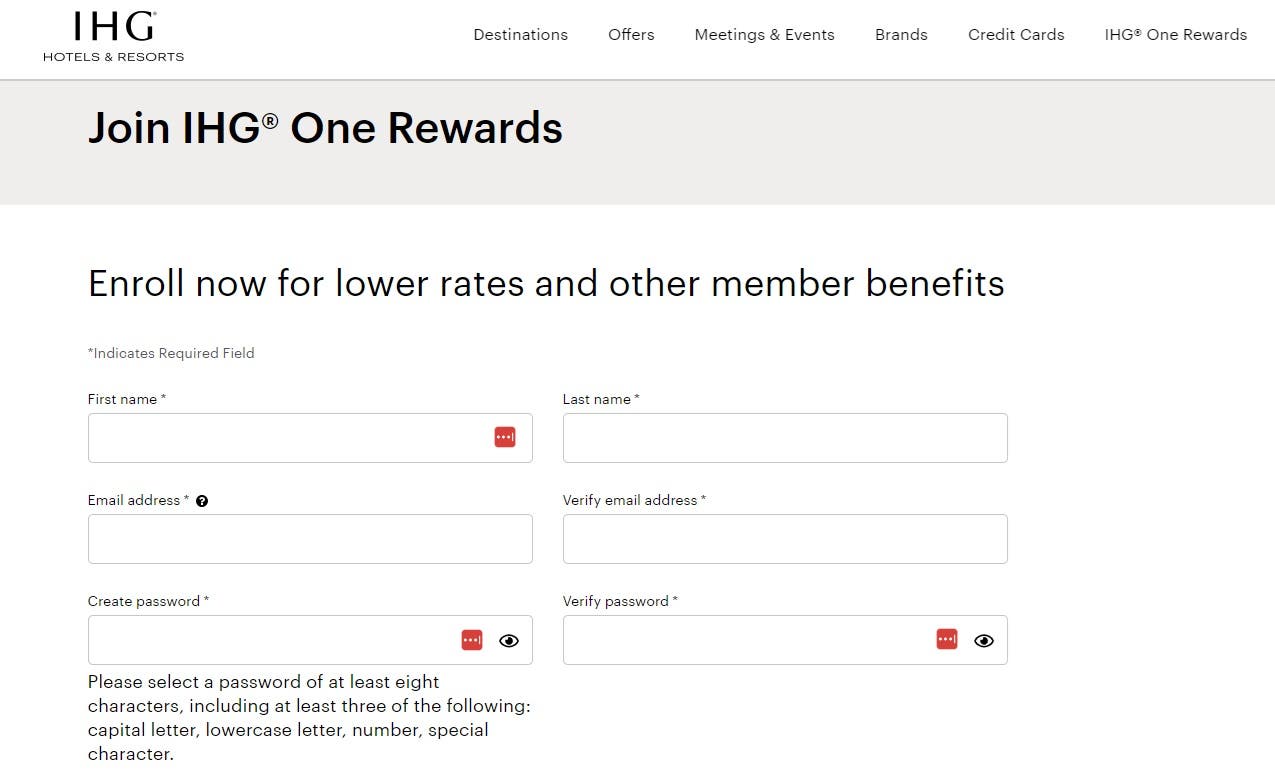

To sign up for IHG One Rewards, follow these simple steps:

Once you provide the information required to create an account, you’ll receive an email with your new loyalty account number, which you can use on the IHG One Rewards login page. You can then begin earning points on hotel stays (and more) right away.

Anyone who wants to earn points for free stays at InterContinental Hotels Group properties should sign up for this program. After all, membership with IHG One Rewards is absolutely free.

After you join IHG One Rewards, you can get on the fast track to earning elite status and award stays in no time. This is especially true if you sign up for a co-branded hotel credit card and begin earning points on hotel stays, travel and other spending.

While you’d get more out of it if you traveled often, it’s still a good program to join if you travel less frequently. This is because joining the program is free and easy to do, so you’ll have nothing to lose by signing up.

As an IHG One Rewards member, you can can earn points in a variety of ways, including when you:

IHG One Rewards members earn up to 10X base points per dollar at most IHG hotels and 5X points per dollar at Staybridge Suites and Candlewood Suites. Also, note that you can earn more points depending on your elite status. The following chart shows how many bonus points you can earn for each membership level:

| Membership level | Club Member | Silver Elite | Gold Elite | Platinum Elite | Diamond Elite |

|---|---|---|---|---|---|

| Bonus points | N/A | 20% | 40% | 60% | 100% |

The IHG One Rewards program also offers Milestone Rewards, which reward you for frequent stays. After you’ve stayed 20 qualifying nights, you’ll be able to choose one reward for every 10 additional nights you stay. Note that select qualifying nights will receive a bonus choice reward, meaning that you’ll be able to choose two rewards instead of one.

Here are the rewards you can choose from:

IHG One Rewards members can earn points through special promotions the loyalty program offers. For example, members can currently earn up to 1,000 points when they book local tours, activities and attractions.

You can also earn IHG One Rewards points with products and packages from IHG partners, including The Venetian Resort stays, Holiday Inn Club Vacations packages, Hertz car rentals, dining reservations with OpenTable and dining with restaurant partners.

IHG offers several co-branded hotel credit cards with Chase as the card issuer. Depending on the card, cardholders can enjoy automatic elite status with the hotel brand, plus additional perks like a fourth night free on award bookings (when booking four consecutive nights with points) and free anniversary nights.

It’s also important to note that IHG One Rewards is a Chase Ultimate Rewards transfer partner, as well as a travel partner with the Bilt Rewards program. This means you can sign up for an elite travel credit card like the Chase Sapphire Preferred® Card or the Bilt Mastercard® and earn points that transfer to your IHG One Rewards account.

If you have a credit card with rewards that transfer to IHG One Rewards, you’ll want to think long and hard before you transfer your points. After all, flexible rewards currencies like Bilt Rewards and Chase Ultimate Rewards are worth considerably more than points in hotel loyalty programs, especially with IHG One Rewards. This means you may only want to transfer your rewards in specific situations, such as if you are short a few thousand points for a redemption you want to make with IHG One Rewards.

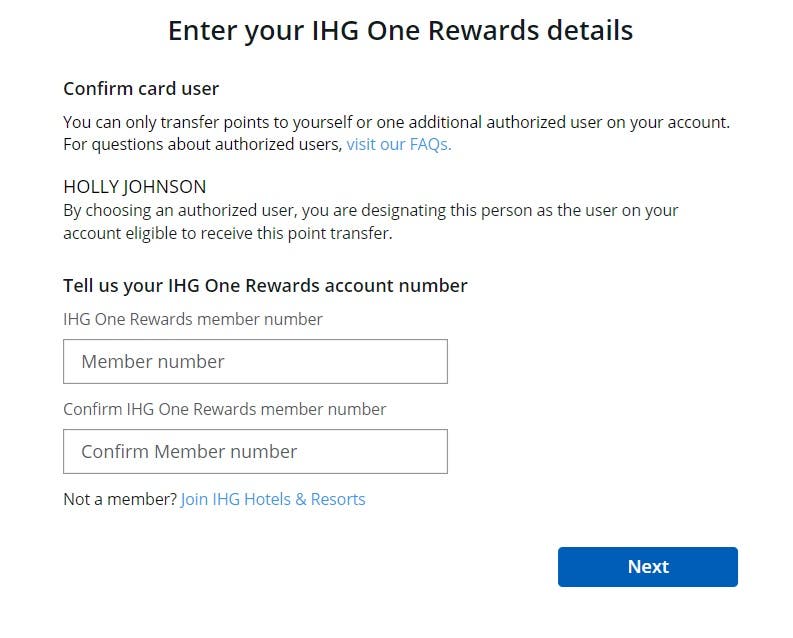

If you do want to transfer points to IHG One Rewards, you can do so through your online account. Here’s an example of the steps required to transfer points from Chase Ultimate Rewards to IHG One Rewards.

If you have never transferred points to IHG One Rewards before, you’ll also need to enter information like your IHG One Rewards membership number before you can move forward.

Chase saves your loyalty program information after you submit it the first time, so you shouldn’t have to enter it next time you want to make a transfer.

There are five IHG One Rewards membership levels. The following chart shows the benefits you’ll receive with each tier, plus the requirements to achieve each level of elite status:

| Club | Silver Elite | Gold Elite | Platinum Elite | Diamond Elite | |

|---|---|---|---|---|---|

| Number of stays or points needed to earn status | N/A | 10 stays | 20 stays or 40,000 points | 40 stays or 60,000 points | 70 stays or 120,000 points |

| Bonus points earned | N/A | 20% | 40% | 60% | 100% |

| Earn points for reward nights | Y | Y | Y | Y | Y |

| No blackout dates for reward nights | Y | Y | Y | Y | Y |

| Member rates and promotions | Y | Y | Y | Y | Y |

| Free internet | Y | Y | Y | Y | Y |

| Late 2 p.m. checkout | Y | Y | Y | Y | Y |

| Points don’t expire | Y | Y | Y | Y | |

| Rollover nights for next year’s status | Y | Y | Y | ||

| Complimentary room upgrades when available | Y | Y | |||

| Guaranteed room availability | 72 hours (blackout dates apply) | 72 hours (blackout dates apply) | |||

| Welcome amenity at check-in | Points or drink/snack | Free breakfast, points or drink/snack | |||

| Early check-in when available | Y | Y | |||

| Reward night discounts | Y | Y | |||

| Dedicated Diamond status support | Y |

The IHG One Rewards program doesn’t have as many redemption options as other programs, but it still offers several ways to redeem your points, such as:

The best redemption option with IHG One Rewards is by far their Rewards Nights. As mentioned before, hotel stays start at 5,000 points per night, and you can also pay for your hotel stay with a combination of points and cash.

You also have the option to redeem your points for merchandise or gift cards. However, you won’t get as much value out of your points with this redemption method.

Another option is to redeem your rewards for digital books, games, movies, music or magazine subscriptions. Note that digital rewards may change based on your location. Also, as with gift cards or merchandise, we don’t recommend this option since you’ll get less value out of your points.

You can also turn your IHG One Rewards points into airline miles, but again, this isn’t a good use of your points. Most airline partners let you turn 10,000 IHG points into 2,000 airline miles, which is a poor transfer ratio. However, there are quite a few airline partners to choose from, and this option could make sense if you need to book an award flight but you’re short on miles.

If you’d rather donate your points to charity, IHG has several nonprofit partners. For example, you can donate your points to the American Red Cross, Goodwill or The Global FoodBanking Network, among others.

According to Bankrate’s latest valuations, IHG One Rewards points are worth about 0.7 cents each. Keep in mind that, while some hotel loyalty points are definitely worth a lot more, they aren’t as easy to earn.

| Hotel program | Average point value* |

|---|---|

| IHG One Rewards | 0.7 cents |

| Best Western Rewards | 0.6 cents |

| Hilton Honors | 0.6 cents |

| Marriott Bonvoy | 0.7 cents |

| Radisson Rewards Americas | 0.4 cents |

| World of Hyatt | 2.3 cents |

| Wyndham Rewards | 0.9 cents |

*Valuations provided by Bankrate

IHG One Rewards has more than 40 airline partners. While you can earn miles or points with all of the following partners, some partners don’t allow you to transfer IHG One Rewards points to airline miles/points.

Here are all of IHG’s airline partners you can earn or transfer rewards with, as well as their transfer rewards rates:

| Airline | Transfer rate |

|---|---|

| Aeromexico | Redeem 10,000 IHG One Rewards points for 2,000 Premier Points |

| Aeroplan | Redeem 10,000 IHG One Rewards points for 2,000 Aeroplan Miles |

| Air China | Redeem 10,000 IHG One Rewards points for 2,000 PhoenixMiles |

| Air France | Redeem 10,000 IHG One Rewards points for 2,000 Miles |

| Air Miles | Redeem 10,000 IHG One Rewards points for 250 miles |

| Air New Zealand | Redeem 10,000 IHG One Rewards points for 25 Airpoints |

| Air Portugal | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| Alaska Airlines | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| ALFURSAN | Redeem 10,000 IHG One Rewards points for 2,000 miles |

| ANA | Redeem 10,000 IHG One Rewards points for 2,000 ANA Mileage Club miles |

| American Airlines | Redeem 10,000 IHG One Rewards points for 2,000 AAdvantage miles |

| Asia Miles | Redeem 10,000 IHG One Rewards points for 2,000 Asia Miles miles |

| Asiana Airline | Redeem 10,000 IHG One Rewards points for 2,000 Asiana Club Miles |

| Avianca Airlines | Redeem 10,000 IHG One Rewards points for 2,000 LifeMiles miles |

| British Airways | Redeem 10,000 IHG One Rewards points for 2,000 Avios points |

| China Airlines | Transfers unavailable |

| China Eastern | Redeem 10,000 IHG One Rewards points for 2,000 China Eastern points |

| China Southern | Redeem 10,000 IHG One Rewards points for 2,000 Sky Pearl Club Kilometers |

| Delta Air Lines | Redeem 10,000 IHG One Rewards points for 2,000 SkyMiles |

| Emirates | Redeem 10,000 IHG One Rewards points for 2,000 Skywards miles |

| Etihad Airways | Redeem 10,000 IHG One Rewards points for 2,000 Etihad Guest Miles |

| Eva Airways | Transfers unavailable |

| Finnair | Redeem 10,000 IHG One Rewards points for 2,000 Avios |

| Gulf Airways | Redeem 10,000 IHG One Rewards points for 2,000 Falconflyer miles |

| Hainan Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Fortune Wings Club points |

| Iberia Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Avios |

| InterMiles | Redeem 10,000 IHG One Rewards points for 2,000 InterMiles |

| Japan Airlines | Redeem 10,000 IHG One Rewards points for 2,000 JAL Miles |

| JetBlue | Redeem 10,000 IHG One Rewards points for 2,000 TrueBlue points |

| Korean Air | Redeem 10,000 IHG One Rewards points for 2,000 SKYPASS miles |

| Malaysia Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Enrich Points |

| MilleMiglia | Redeem 10,000 IHG One Rewards points for 2,000 MilleMiglia miles |

| Qantas Airlines | Redeem 10,000 IHG One Rewards points for 2,000 Qantas Points |

| Singapore Airlines | Redeem 10,000 IHG One Rewards points for 2,000 KrisFlyer miles |

| South African Airways | Redeem 10,000 IHG One Rewards points for 2,000 Voyager miles |

| Thai Airways | Redeem 10,000 IHG One Rewards points for 2,000 Royal Orchid Plus miles |

| United Airlines | Redeem 10,000 IHG One Rewards points for 2,000 MileagePlus miles |

| Virgin Atlantic | Redeem 10,000 IHG One Rewards points for 2,000 Virgin Points |

| Virgin Australia | Redeem 10,000 IHG Rewards points for 2,000 Velocity Points |

The IHG One Rewards program has a lot to offer, especially given that it’s free to sign up for. With 19 brands included under the IHG umbrella, there are plenty of opportunities to stay at one of their properties and earn points towards a free Rewards Night.

Because IHG partners with multiple airlines, it’s also easy to earn points that can transfer to your favorite airline — though the transfer rate between IHG One Rewards and airline loyalty programs isn’t very high.

A co-branded IHG credit card can help you earn even faster, especially given the generous rewards structures of their card offerings. But if you won’t be booking hotel stays often enough to earn the free nights or higher rewards tiers, a hotel credit card may not be your best option. You might even do better with a traditional travel rewards credit card that lets you redeem points for additional options outside of hotel stays.

Whether you decide to boost your rewards points with a credit card or not, you have nothing to lose by signing up for this free program.

Yes, IHG One Rewards points can expire after 12 months of inactivity if you are a basic Club member. For all other membership levels, your points will not expire as long as you maintain elite level status.

Yes, you can share points with other IHG One Rewards members. Note that the member sharing the points must pay a fee of $5 for every 1,000 points that are transferred.

Arrow Right Author, Award-Winning Writer

Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics. In addition to writing for Bankrate and CreditCards.com, Johnson does ongoing work for clients that include CNN, Forbes Advisor, LendingTree, Time Magazine and more.